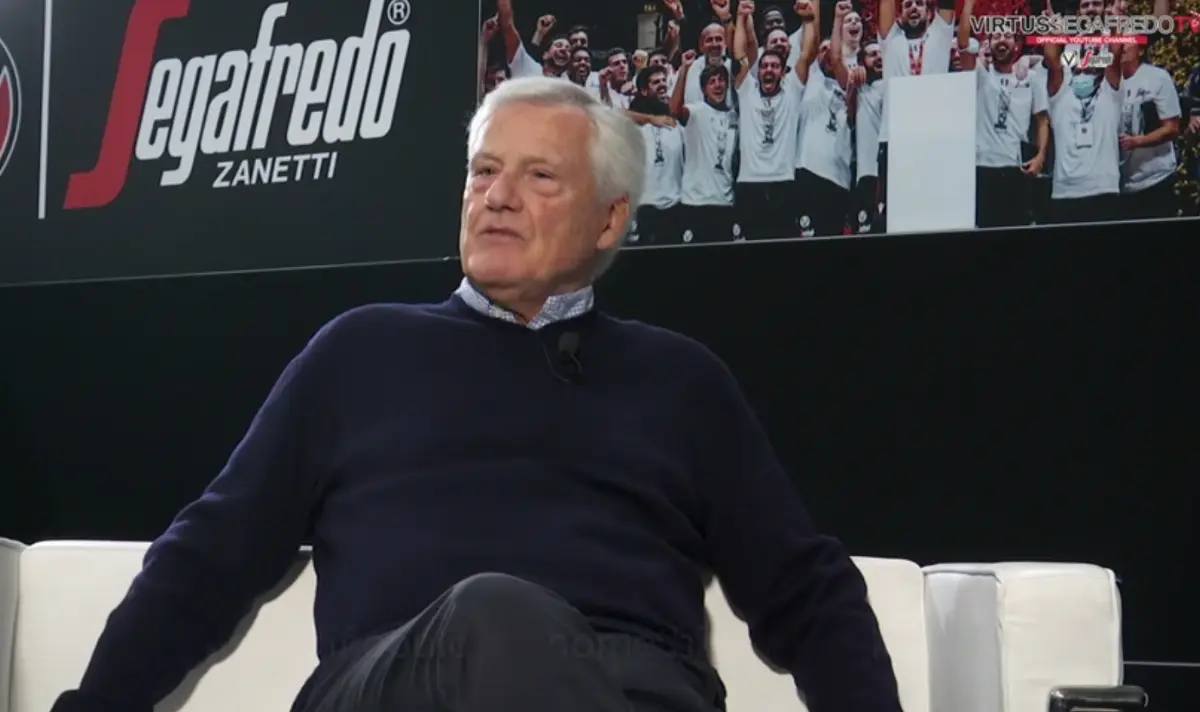

Segafredo, Massimo Zanetti will sell 50% to the QuattroR fund

"My family will remain the owner," says the owner of MZ Beverage Group

Massimo Zanetti Beverage Group will sell 50% of the shares to the Private equity fund QuattroR. What will happen has explained the same Zanetti, speaking to Corriere del Veneto, in fact confirming the rumors that were leaked a month ago and that we had punctually reported.

The fund will subscribe to a capital increase of 90 million Euro and will have the majority of voting rights: the idea is that the fund remains in the share capital for 3-4 years then exit, thanks to the return to the Segafredo Group Stock Exchange, even if not in Milan. QuattroR, asked by EFA News about the situation, replied that "no operation was finalized and no comment at this stage by QuattroR".

All this because the recapitalisation carried out by Zanetti himself with personal resources of 50 million Euro was not considered suitable by the banks "after a third year of poor balance sheets", as the owner himself points out.

"Now QuattroR will express the managing director in the figure of Pierluigi Tosato while I will remain president -says Zanetti-. At the end of the experience, the family will undoubtedly continue to own the group and we will re-list Mzbg on the Stock Exchange, but not in Italy. Our presence is all over the world and so we think of squares like New York or Singapore".

An agreement with creditors, which is a necessary condition to close the contract with QuattroR, is expected next week or, in any case, by December. In any case, Zanetti still assures, the company will not be sold. "It is clear -emphasizes the manager- that remaining with 50% my engagement will be diluted but, moreover, I have 75 years. Then if my children intend to follow the same path, well; otherwise they will decide how to behave".

"The companies in this sector are all recovering -concludes Zanetti-. We will close 2023 with a turnover higher than last year’s record: the aggregate, together with 290 million of the raw company Cofiroasters, had reached 1.5 billion, with an ebitda of 48 million. It is a shame to have to resort to external partners right now, but the position of the banks must be understood".

EFA News - European Food Agency